A number of construction machinery companies in the third quarter to achieve a rebound in performance.

Image source: Visual China

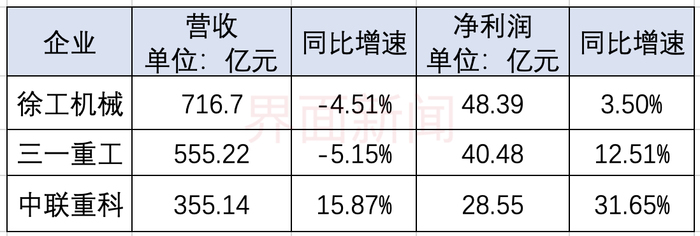

In the first three quarters of this year, the three leading construction machinery companies have achieved net profit growth, but in a single quarter, Sany Heavy Industry (600031.SH) has experienced a decline in performance, and Zoomlion (000157.SZ) has a large increase in net profit.

Whether it is the scale of revenue or net profit in the first three quarters, XCMG Machinery (000425.SZ) ranked first after the overall listing, but the company's revenue declined, 71.67 billion yuan, a year-on-year decrease of 4.51%; net profit was 4.839 billion yuan, a slight increase of 3.5% year-on-year.

Sany Heavy Industry (600031.SH), whose revenue in the first three quarters was 5.522 billion yuan, a year-on-year decrease of 5.15%; net profit was 4.048 billion yuan, a year-on-year increase of 12.51%.

Comparison of the performance of the three major construction machinery leaders in the first three quarters Drawing: Ma Yueran

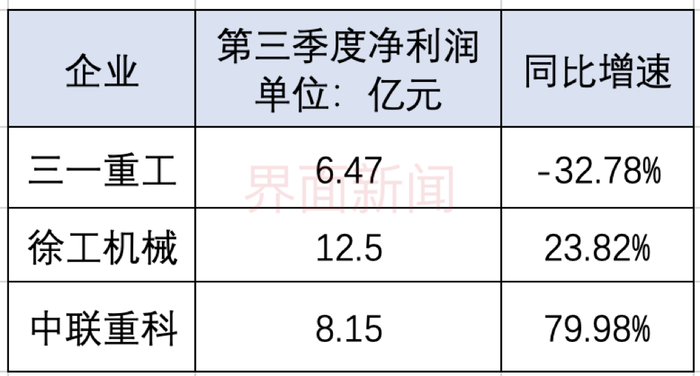

In a single quarter, Sany Heavy Industry's net profit in the third quarter was 647 million yuan, a year-on-year decrease of 32.78%, and it was also the first company with a single-quarter decline among the three leading companies.

In the second quarter of this year, Sany Heavy Industry's net profit was about 1.888 billion yuan. Based on this calculation, the company's net profit in the third quarter fell by 65.7% from the previous quarter.

Comparison of the performance of the three leading construction machinery companies in the third quarter Chart: Ma Yueran

Sany Heavy Industry said that its net profit in the third quarter declined, mainly due to the decrease in government subsidies related to revenue received and the impact of exchange rate changes.

During the same period, the exchange losses caused by the receivables and payables and foreign currency funds due to exchange rate changes were classified as recurring losses, and the forward foreign exchange contract income generated by foreign exchange locking operations was included in non-recurring profits, resulting in a year-on-year decline of nearly 60% in non-net profit.

Guojin Securities also mentioned in the analysis of the research report that the decline in the net profit of Sany Heavy Industry was also affected by the decline in export growth.

At present, the construction machinery industry is still in a downward adjustment cycle. According to the data of China Construction Machinery Industry Association, in the first nine months of this year, excavator sales were declining year-on-year, and the decline in September was more than three percent, of which the domestic market continued to be sluggish.

In terms of excavator exports, the growth rate from February to May is considerable, but since June, excavator exports have continued to decline year-on-year, and the decline has been expanding, and exports in September fell by about 25% year-on-year.

Zoomlion specifically mentioned the growth of overseas revenue in its financial report. The company said that domestic revenue in the first three quarters was 22.485 billion yuan, a year-on-year decrease of 6.9%; overseas income was 13.029 billion yuan, a year-on-year increase of 100.53%.

Up to now, Zoomlion's overseas revenue has accounted for about 36.7% of its total revenue, a record high.

Zoomlion is also the fastest growing enterprise in the third quarter of the three leading enterprises. Its revenue in the third quarter was 11.439 billion yuan, a year-on-year increase of 22.35%; net profit was 815 million yuan, a year-on-year increase of 79.98%.

XCMG Machinery's net profit in the third quarter increased by more than two percent year-on-year, but this growth rate narrowed month-on-month. The company's net profit in the second quarter was about 2.066 billion yuan, a year-on-year increase of about 30%.

XCMG Machinery said in the first investor relations activities that the overseas market will maintain a good trend in the future. Based on the continuous recovery of the economy and the current good trend of the construction machinery export market, the export market can still maintain good growth.

The company believes that in the medium and long term, the overseas market has growth characteristics for domestic brands, and with the normalization of overseas economic activities, the pent-up demand in overseas markets will continue to be released. In addition, with the improvement of the quality of domestic products, the channel layout of domestic enterprises in overseas is becoming more and more perfect, the comprehensive competitiveness of domestic brands is improving, and the penetration rate of overseas markets will also increase.

XCMG also said that in the domestic market, with the gradual emergence of policy effects and the continuous embodiment of updated demand, the head enterprises are expected to take the lead in stabilizing by virtue of scale advantages, industrial layout advantages, reform dividends and modernization of governance.

Zoomlion also recently said that in the second half of the year, under the background of steady growth, as the country strengthens the foundation for economic recovery and development, local governments accelerate the promotion of special bonds to accelerate major projects, real estate regulation and control policies continue to relax, and the demand for infrastructure and real estate projects is expected to be gradually released, driving the demand for equipment to pick up.

In addition to the leading enterprises, the performance of many companies in the construction machinery sector has rebounded significantly in the third quarter. For example, Shantui (000680.SZ) net profit in the third quarter increased by 1.38 times year-on-year, and Liugong (000528.SZ) net profit increased by 99.2% year-on-year in the same period.

Sany Heavy Industry also mentioned that its gross profit margin has increased in the third quarter.

Bohai Securities Research Report believes that from the downstream demand, since September, many cities across the country have been optimizing the real estate policy, and it is expected that with the downstream start into the peak season and the real estate policy continues to be good, the domestic demand for construction machinery is expected to gradually rebound. With the improvement of the comprehensive competitiveness of China's construction machinery products in the global market, the overseas market is expected to become an important force to hedge the decline in domestic sales.